Silicone elastomers are essential materials in modern engineering, providing flexibility, durability and high-performance capabilities across various industries. Their compressibility, combined...

Sur-Seal, a leader in the field of engineered sealing solutions, has acquired Spectex

CINCINNATI, OHIO – (August 2, 2021) – Sur-Seal® Company, a leader in the custom sealing solutions industry has acquired Spectex™, a New Hampshire-based company specializing in custom engineering, converting, and manufacturing of flexible materials. The acquisition will help Sur-Seal and Spectex meet the needs of their expanded customer base.

“We are excited about the acquisition of Spectex, knowing how well they meet their customers’ needs for custom engineering and manufacturing,” explains Larry Faist, president and chief executive officer of Sur-Seal. “We value their experience and leading capabilities with a wide range of performance materials, from carbonized felt to specialty textiles to elastomers and plastics. We look forward to presenting these capabilities to Sur-Seal’s customers.”

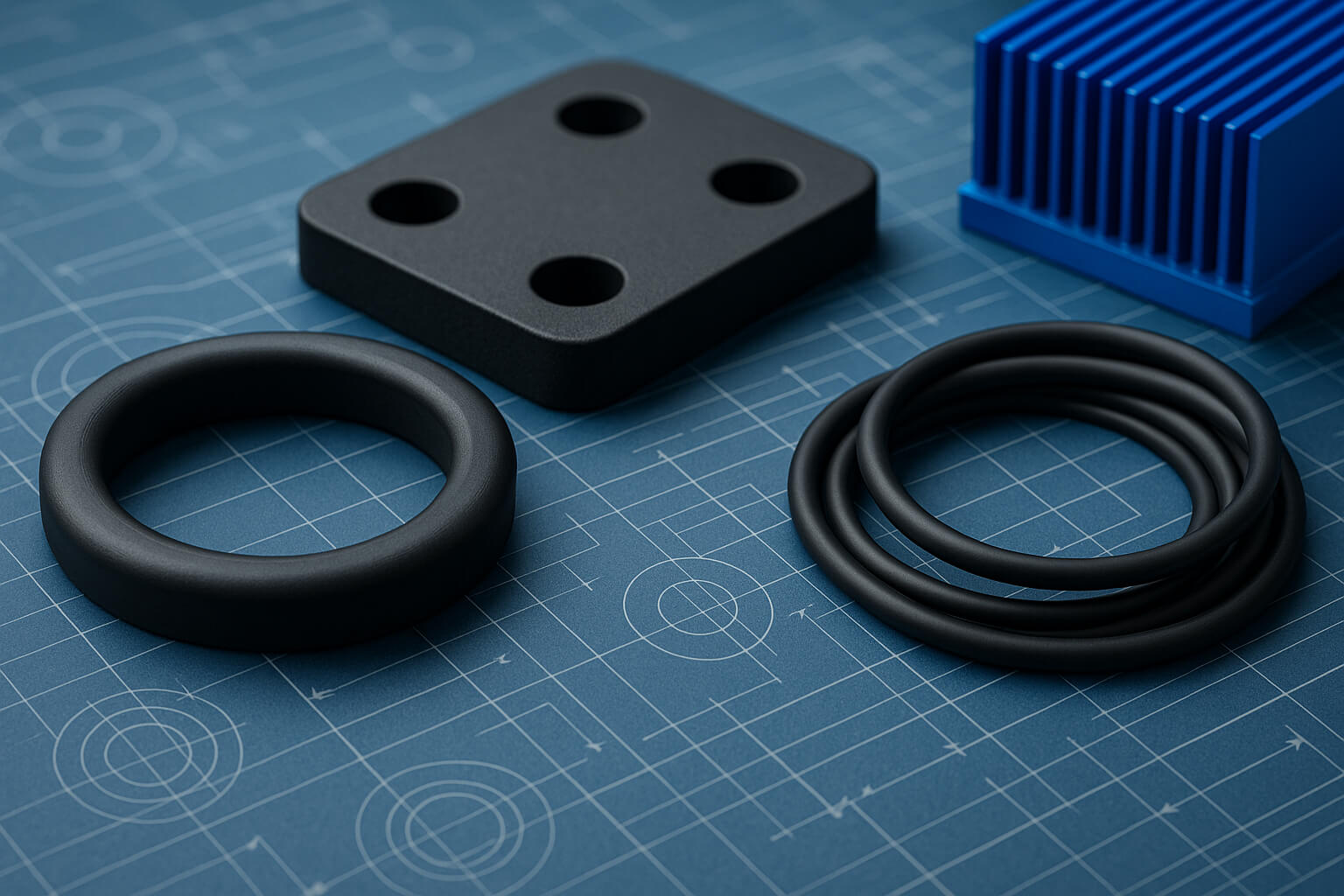

The acquisition creates a stronger combined business that will benefit customers through the expansion of manufacturing and distribution locations, enhanced engineering and material development capabilities, and an ability to serve more industries. The combined organization will continue to provide high-quality products, including gaskets, thermal pads and silicone optics, using the most effective manufacturing techniques available, including custom extrusion, molding, die-cutting, injection molding, and more.

“We are pleased to be acquired by Sur-Seal, a company that shares a common mission and values,” says Steve Rossi, general manager at Spectex. “Our joint resources will improve our materials engineering expertise and market reach to better serve our customers and support growth overall.”

About Sur-Seal

Sur-Seal® Company, headquartered in Cincinnati, Ohio with service centers in Ohio, Mexico, and China, strives to live a mission of being Rapid, Right and Reliable. The company does business in 25 countries, with over 200 OEM customers, including 15 long-term Fortune 500 partners. Sur-Seal® was founded as a family owned and run business in 1965 and is currently owned by Heartwood Partners, a Connecticut based private equity firm. Sur-Seal is a company with a passion for fostering a strong culture and is proud to have been recognized as a Best Place to Work locally and nationally. Spectex™, a Sur-Seal, is a New Hampshire-based provider of custom engineering, converting and manufacturing of flexible materials. Spectex was founded by Victor Pisinski and Kevin Stanley in 2001 and has a history of providing solutions for such industries as medical, aerospace, industrial, and others. For more information about Sur-Seal or Spectex, visit the sites at: https://www.sur-seal.com or https://www.spectex.com

About Heartwood Partners

Heartwood Partners, located in Norwalk, Connecticut, is a middle market private equity firm founded in 1982. Heartwood currently manages over $1 billion in investments and commitments and our principals have invested in more than 100 platform and add-on acquisitions. Presently, the firm is investing from a $600 million fund focused primarily on family and management-owned manufacturers, value-added distributors, food, chemical, consumer products and business service companies, Heartwood is differentiated by a unique lower-leverage, distribution-yielding approach to private equity designed to create equity partnerships with continuing management. For more information about Heartwood Partners, visit the site at: www.heartwoodpartners.com